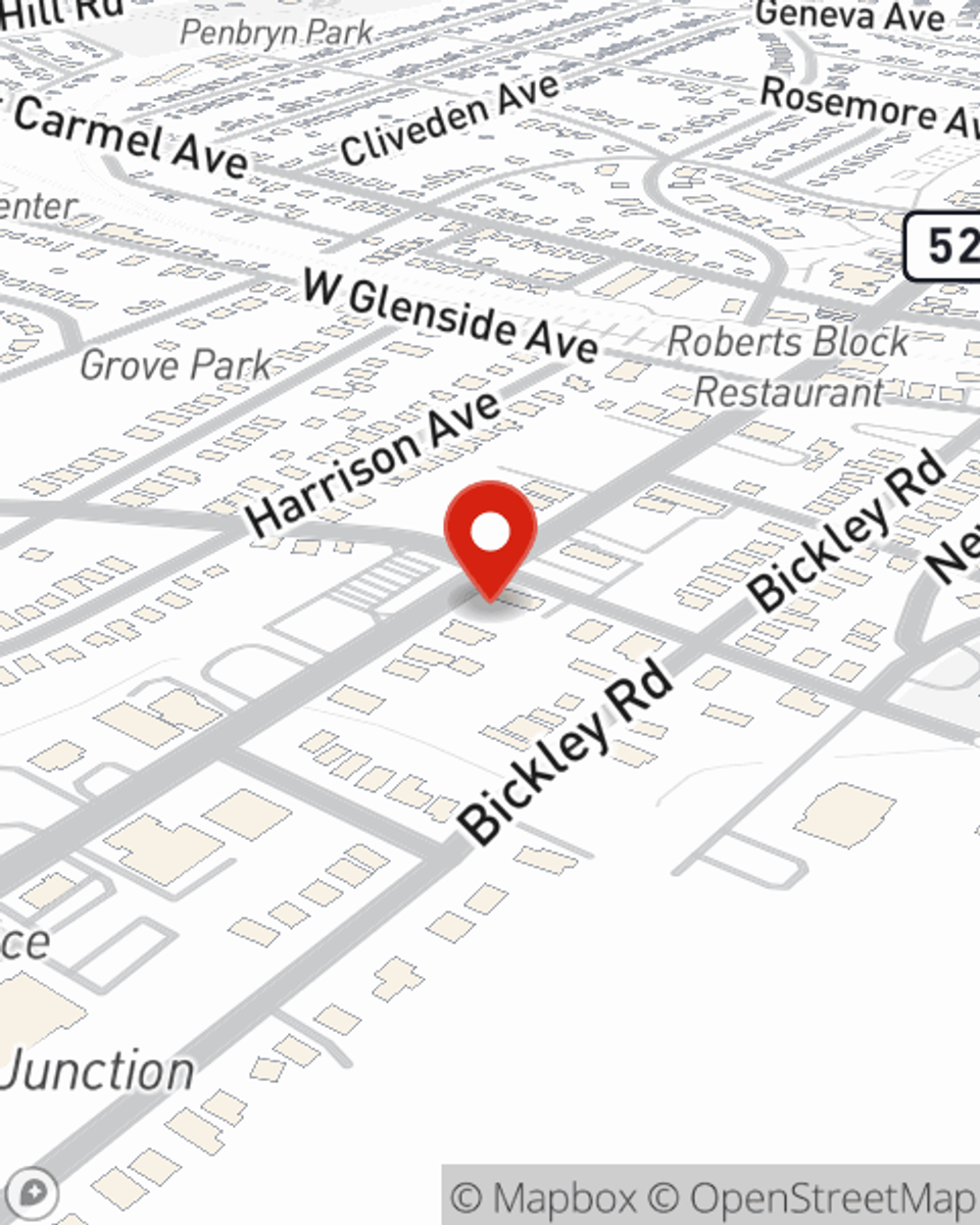

Business Insurance in and around Glenside

Get your Glenside business covered, right here!

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for the ones you care for. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with a surety or fidelity bond, extra liability coverage and business continuity plans.

Get your Glenside business covered, right here!

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a camping store, a pet groomer or a gift shop. Agent Stephanie Raieta is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Call Stephanie Raieta today, and let's get down to business.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Stephanie Raieta

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.